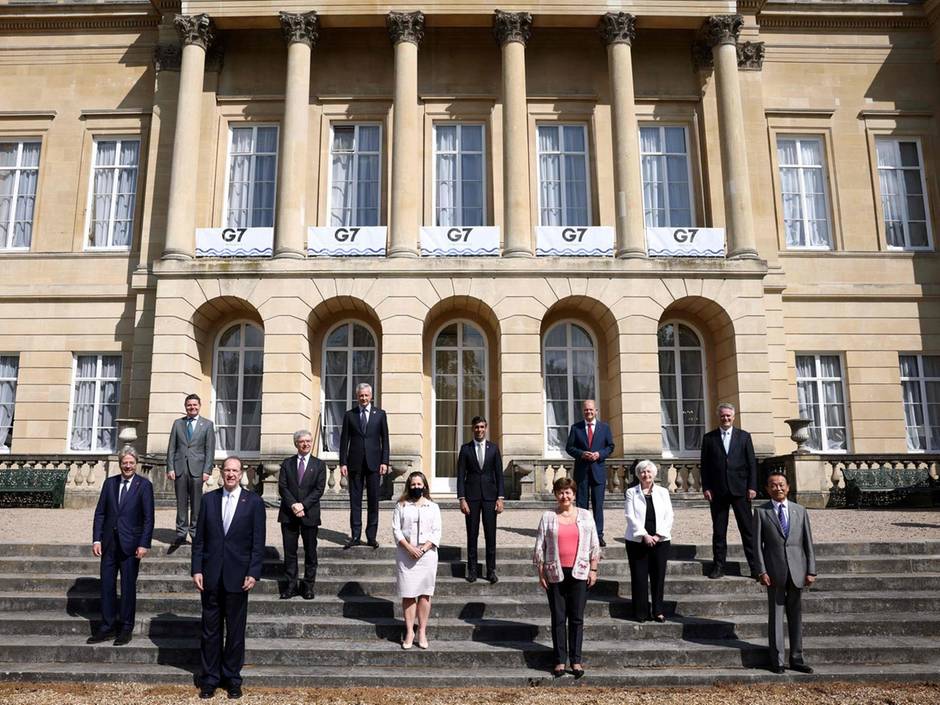

International summits can sometimes be dull and formulaic, but there is a decided buzz about this week’s meeting of leaders of the Group of Seven advanced economies. The G7 summit is in an iodine-rich Cornish seaside resort and it is in person, a sign that the most severe pandemic restrictions are slowly being wound down. But more importantly, it is expected to pronounce on a global corporate tax pact, something that the G7 finance ministers recently agreed.

If the G7 leaders also declare a common position in favour of a global minimum corporate tax, the implications are profound. The world’s richest democracies will have spoken in favour of overhauling the system, which is currently unable to decree how much tax multinational companies pay, and where.

Corporate giants would no longer be able to dodge tax liabilities by choosing to book profits in low-tax jurisdictions. Countries where companies sell goods or services would have taxing rights on a percentage of the profits that accrue from their territories. The era of a rich corporate entity paying little or nothing to any national government, anywhere, would be over. It would be, as German Finance Minister Olaf Scholz has said, a “revolution” in global tax rules that date back to the 1920s. More to the point, it would come at a time when governments badly need to raise revenue to offset record levels of public borrowing on account of the coronavirus crisis. In 2020, governments around the world spent an estimated $16 trillion battling the pandemic, and the average country’s public debt now stands at 99 per cent of GDP (up from 83.7 per cent in 2019).

So, will a global minimum corporate tax come to pass? Some of the initial heavy lifting has already been done. In May, the Biden administration declared its support for revamping the international system and preventing a “race to the bottom” as countries slash tax rates to lure business. And at a two-day meeting in London just last week, the G7 finance ministers agreed on the specifics of a minimum corporate tax rate. It would be, they said, at least 15 per cent and countries would have the right to tax “at least 20 per cent of profit exceeding a 10 per cent margin for the largest and most profitable multinational enterprises”.

What all of this means, in real terms, is stark. According to published estimates, anywhere between $100 billion and $600bn a year would be collected by governments if the system were suitably reformed to ensure corporate entities pay their fair share. Legal tax avoidance to the tune of billions by any single multinational would no longer be possible and governments would not be deprived of badly needed revenue.

Consider the findings of a newly published study by a Dutch non-profit, the Centre for Research on Multinational Corporations. Media giant ViacomCBS, the report said, along with its predecessor companies, Viacom and CBS, managed to avoid paying nearly $4bn in US corporate income tax from 2002 by means of a complex system that involved subsidiaries in Barbados, the Bahamas, Luxembourg, the Netherlands and Britain.

Back in 2013, a US Senate report said that Apple Operations International, registered in Cork, Ireland, earned $30bn in overseas profits over a four-year period without paying a dime of corporate income tax to the Irish, American or any other national government. The Senate report analysed how that happened, not least the reality that Apple had “no physical presence at that [Cork] or any other address”, was not managed and controlled in Ireland and wasn’t registered in the US either. Accordingly, Ireland didn’t tax its earnings and the company didn’t owe American taxes either. Apple subsequently said it did not “use tax gimmicks” and just like ViacomCBS more recently, insisted that it had fulfilled its obligations.

This is true. Corporations, particularly giant tech companies such as Apple, Google and Facebook, do fulfil their legal obligations. But for all too long, they have been able to get away with clever tactics of tax avoidance. It’s worth noting that tax avoidance is legal; evasion is illegal.

Success is not assured but it’s clear there is a new urgency about the need to transition

A 2018 study said that roughly 40 per cent of multinationals’ overseas profits are artificially shifted to low-tax countries, a legal way to avoid tax liabilities. Ireland and Cyprus, which are routinely described as “business-friendly” countries, feature in tax avoidance schemes because they keep corporate tax rates low at 12.5 per cent. The Netherlands and Luxembourg, meanwhile, have rules that help companies legally avoid tax in other countries. And Caribbean idylls such as Bermuda, the British Virgin Islands and the Cayman Islands legally run zero-tax regimes. Many of these jurisdictions argue, with some merit, that they are within their rights to use competitive tax policies to attract foreign investment.

Right around the time Apple got a bad rap from the US Senate, Eric Schmidt, Google’s then executive chairman, articulated the thinking of big corporations. “This is how international tax regimes work,” he said, adding that no computer scientist would design so poor a tax system as exists and tax determination is not for companies to make, but for countries and their governments.

In other words, the world must design a tax system that’s fit for purpose.

Fair enough. Now that G7 leaders (plus four guests from non-member countries) are debating an international deal, the process of re-design may now be properly under way.

The next hurdle will be the Venice meeting in July of G20 countries, which represent 80 per cent of global GDP. If the G20 gets on board as well, it will be a boost for the Organisation for Economic Co-operation and Development, which has for years been co-ordinating negotiations among 139 countries for years on how to tax companies in a globalised, digital economy.

Success is not assured but it’s clear there is a new urgency about the need to transition. The current rules of international taxation were built for a bricks-and-mortar economy. If the world is to find solutions to 21st century global problems such as pandemics and climate change, it needs a fair and viable system that taxes income from intangible sources.

Rashmee Roshan Lall is a columnist for The National